MBA Salary Calculator with Cost of Living Adjustment

Calculate Your Net Income

Your Net Income

When people ask what the highest paying MBA degree is, they’re not just curious about the title on a diploma. They want to know where to invest two years of their life, thousands of dollars, and a lot of effort-and get real, measurable returns. The answer isn’t a single program name. It’s a mix of specialization, school reputation, location, and industry demand. And in 2025, the landscape has shifted again.

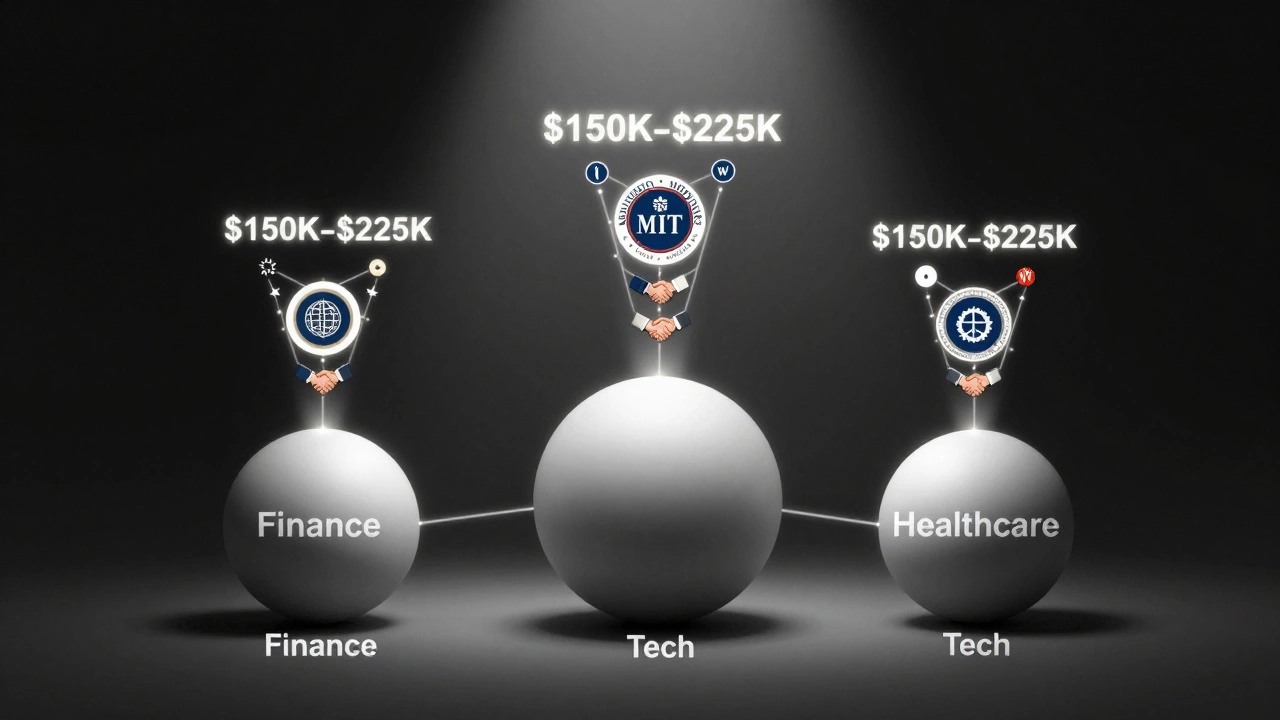

Finance Still Leads, But It’s Not the Only Game in Town

For over a decade, MBA graduates in finance have topped salary charts. That hasn’t changed. But now, the top earners aren’t just working at Goldman Sachs or JPMorgan. They’re in hedge funds, private equity firms, and venture capital startups that pay out in carry and bonuses, not just base salary.

According to data from the Graduate Management Admission Council (GMAC) and salary reports from top U.S. and European business schools, MBA graduates in finance roles earned a median starting salary of $135,000 in 2025. At elite schools like Wharton, Chicago Booth, or INSEAD, the median for finance roles hit $150,000. But here’s the catch: those numbers include bonuses. Base salaries are often closer to $110,000-$125,000. The real pay comes from performance-based payouts.

That’s why finance isn’t the only path anymore.

Technology and Product Management Are Surging

Think tech = software engineers? Not anymore. The highest-paid MBAs in tech aren’t coders-they’re product managers, strategy leads, and startup founders with MBA degrees.

Companies like Google, Meta, Microsoft, and Apple now hire MBAs directly into product management roles with starting salaries of $140,000-$160,000. Add in stock grants and bonuses, and total compensation often hits $200,000 in year one. At top-tier tech startups, especially in AI and fintech, early-stage MBAs can earn equity worth hundreds of thousands-or even millions-if the company succeeds.

Why? Because tech companies need leaders who understand both business and engineering. An MBA with a focus on technology management or digital transformation can bridge that gap better than any engineer alone. Schools like Stanford GSB, MIT Sloan, and Berkeley Haas have doubled their tech-focused MBA tracks since 2020. Enrollment is up 47%.

Healthcare Management Is the Quiet Winner

Most people don’t think of healthcare when they think MBA. But hospitals, pharmaceutical giants, and health tech firms are desperate for leaders who can manage budgets, navigate regulations, and scale innovations.

Graduates from programs like the University of Pennsylvania’s Wharton Healthcare Management track or the University of Michigan’s Ross School of Business Healthcare concentration are landing roles at Pfizer, UnitedHealth Group, and CVS Health with median starting salaries of $128,000. In consulting firms focused on healthcare (like McKinsey Health Practice or Bain Health), salaries jump to $145,000+.

What’s driving this? Aging populations, rising drug costs, and AI-powered diagnostics. These aren’t trends-they’re structural shifts. Healthcare is now the second-largest industry in the U.S. economy after tech. And it needs MBAs to run it.

Consulting Is Still a Major Pay Driver

Management consulting remains one of the most reliable paths to high pay after an MBA. Firms like McKinsey, BCG, and Bain pay new hires $150,000-$170,000 total compensation in North America. That includes signing bonuses, relocation, and performance incentives.

But here’s what most people miss: the pay isn’t just about the title. It’s about the exit strategy. Consultants often leave after 2-3 years to join Fortune 500 companies as directors or VPs. Their MBA becomes a launchpad-not an endpoint.

Top consulting hires come from schools like Harvard Business School, Stanford, and London Business School. But even mid-tier schools like Emory Goizueta or UNC Kenan-Flagler are seeing strong placement in regional consulting firms, with starting salaries around $110,000.

What About Entrepreneurship?

Yes, you can start your own company with an MBA. And yes, some do become billionaires. But here’s the reality: most MBA entrepreneurs don’t make money right away. In fact, 60% of MBA startup founders report negative cash flow in their first year.

That said, if you’re in the right ecosystem-Silicon Valley, Boston, Toronto, or Tel Aviv-and you’ve got access to venture capital networks through your MBA program, the upside is massive. Schools like Stanford, MIT, and the University of Toronto’s Rotman School have incubators that fund student startups. Rotman’s Creative Destruction Lab has helped launch over 100 AI and clean tech startups since 2015, with several now valued over $100 million.

So if you’re aiming for high pay, entrepreneurship isn’t the safest bet. But if you’re aiming for outsized returns, it’s the only path that can beat the corporate ladder.

Location Matters More Than You Think

Two MBAs from the same school, same specialization, same year-same job offer? Not if one is in New York and the other is in Cincinnati.

Salaries in major financial hubs (New York, San Francisco, London, Singapore) are 30-50% higher than in smaller cities. But cost of living is also higher. A $150,000 salary in San Francisco doesn’t go as far as $110,000 in Atlanta.

Here’s a quick comparison based on 2025 data:

| City | Median Base Salary | Median Total Compensation | Cost of Living Index (U.S. Avg = 100) |

|---|---|---|---|

| San Francisco | $145,000 | $195,000 | 185 |

| New York | $140,000 | $190,000 | 160 |

| Toronto | $115,000 | $145,000 | 110 |

| Chicago | $120,000 | $155,000 | 105 |

| Atlanta | $105,000 | $130,000 | 92 |

So if you’re looking for the best balance of pay and lifestyle, Toronto, Chicago, or even Austin are strong options. You’ll still earn well-and keep more of it.

Which MBA Programs Deliver the Highest Pay?

It’s not just about the specialization. The school matters. Top programs have stronger alumni networks, better corporate partnerships, and more access to high-paying recruiters.

Based on 2025 salary reports, these MBA programs delivered the highest median total compensation for graduates:

- Stanford GSB - $225,000 (tech and finance roles)

- MIT Sloan - $210,000 (tech product and operations)

- Wharton - $205,000 (finance and consulting)

- Harvard Business School - $200,000 (consulting and general management)

- INSEAD - $195,000 (global roles, Europe/Asia)

- University of Toronto - Rotman - $155,000 (finance, tech, healthcare in Canada)

Notice something? All of these schools are highly selective. Acceptance rates are under 15%. But they also offer generous scholarships. If you’re admitted, you might pay 30-50% less than the sticker price.

Is an MBA Worth It? The Real ROI

Let’s say you spend $150,000 on tuition, living expenses, and lost salary over two years. After graduation, you make $150,000 a year. It takes you about 18 months to break even. After that, you’re ahead.

But here’s what most calculators miss: the long-term growth. MBAs don’t just get higher starting salaries. They get promoted faster. A 2024 study by the Harvard Business Review found that MBA holders reach VP-level roles 2-3 years faster than non-MBAs in the same companies.

By age 40, the average MBA graduate earns $250,000-$350,000. The average non-MBA with the same experience earns $160,000-$200,000. That’s a $1.5 million difference over a 20-year career.

So yes, an MBA is expensive. But for the right person, with the right specialization and school, it’s one of the highest ROI investments you can make.

What If You Can’t Get Into a Top School?

You don’t need a Stanford MBA to earn $150,000. Many mid-tier schools have strong regional networks. For example:

- University of Texas at Austin (McCombs) - strong in tech and energy

- University of Washington (Foster) - great for tech and healthcare in the Pacific Northwest

- University of Toronto (Rotman) - top in Canada for finance and consulting

- Indiana University (Kelley) - solid for supply chain and manufacturing roles

These schools don’t have the global name, but they have the local power. And in many industries, local reputation matters more than global prestige.

Also, consider part-time or online MBAs from reputable schools. Programs like UNC Kenan-Flagler’s online MBA or NYU Stern’s part-time program have the same curriculum and same recruiters as their full-time versions. Many employers don’t even distinguish between them anymore.

Final Advice: Pick Based on What You Want to Do, Not Just What Pays the Most

It’s tempting to chase the highest salary. But if you hate finance, you won’t last six months in a hedge fund. If you hate consulting, you’ll burn out before your bonus hits your account.

The best MBA for you isn’t the one that pays the most. It’s the one that aligns with your strengths, interests, and long-term goals.

Ask yourself: Do you love numbers and markets? Go finance. Do you want to build products people use? Go tech. Do you care about health outcomes? Go healthcare. Do you like solving big problems for big companies? Go consulting.

Salary follows passion-when it’s paired with the right skills and network.

What MBA specialization has the highest salary in 2025?

Product management in tech and private equity in finance are tied for the highest median total compensation at $200,000-$225,000 for graduates from top programs. However, salaries vary widely based on location, company, and experience level.

Is an MBA worth the cost?

For most people in high-growth industries like tech, finance, or healthcare, yes. The average MBA graduate breaks even on their investment within 18-24 months and earns over $1 million more over their career than non-MBA peers with similar experience.

Can you get a high-paying job with an online MBA?

Absolutely. Top employers like Amazon, Microsoft, and Deloitte hire graduates from accredited online MBA programs at the same salary levels as full-time MBAs. What matters is the school’s reputation and your network-not the delivery format.

Do Canadian MBA programs pay as well as U.S. ones?

Canadian MBA programs like Rotman and Ivey offer starting salaries of $115,000-$155,000, which is 20-30% lower than top U.S. schools. But cost of living is also lower, and work-life balance is better. For many, the trade-off is worth it.

What’s the fastest way to earn back your MBA investment?

Join a consulting firm or a tech company with a strong bonus structure. These roles often offer signing bonuses of $20,000-$40,000 and performance bonuses that can equal 20-30% of your base salary. Most graduates recover their costs within 12-18 months.